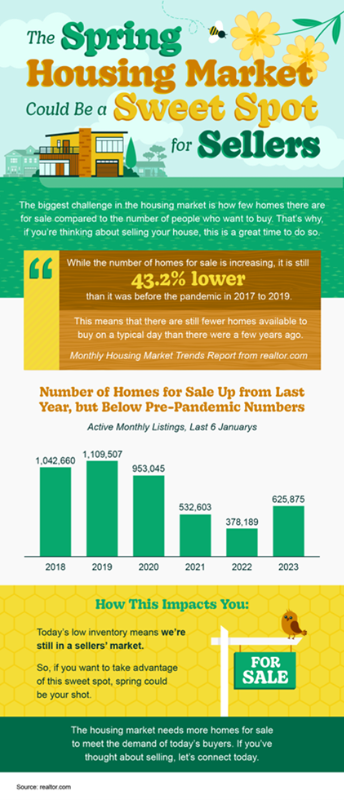

As we move through the early part of 2023, housing experts maintain a watchful eye on the economy, which continues to be pulled in all directions by high inflation, steep interest rates, ongoing geopolitical uncertainties and recession fears, to name a few. Yet, even as home prices appear to be coming back to Earth after a meteoric rise over the past couple of years, high interest rates coupled with appreciated home values still make it difficult for many prospective buyers to access affordable housing. Low housing inventory has been a challenge since the 2008 housing crash when the construction of new homes plummeted. It hasn’t fully recovered—and won’t in 2023. A key difference now compared to the 2008 housing crisis is that many homeowners, and even those struggling to make payments, have had a large boost to their home values in recent years. That means they still have equity in their homes and are not underwater—when you owe more than the house is worth. Buying a house—in any market—is a highly personal decision. Because homes represent the largest single purchase most people will make in their lifetime, it’s crucial to be in a solid financial position before diving in. Forbes Advisor, 3/16/23 Team Linda Stewart is here to help you sort through the details in today’s challenging market. If it Matters to you, It Matters to Us!

Create an Account

Search the MLS and featured property listings in real time.